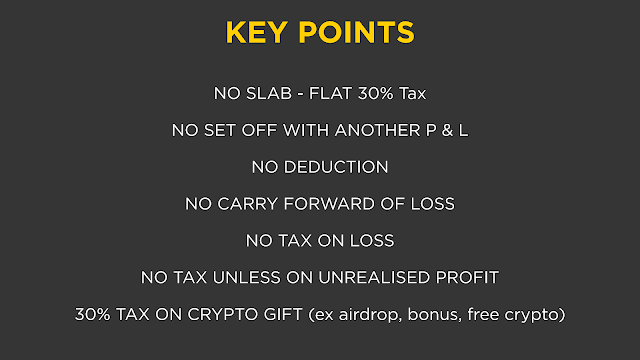

30 Percentage tax on crypto assets, NFT

The Union Budget 2022 proposes taxing gains from the selling

of virtual digital assets at a flat 30% rate. Cryptocurrencies and non-fungible

tokens will be included (NFTs). In her budget speech, Nirmala Sitharaman

announced plans to create a new Section 115BBH of the Income Tax Act to tax

cryptocurrencies in India.

The loss from the sale of virtual assets cannot be offset

against any other revenue. A 1% TDS will be applied to payments made for

digital asset transfers. If you donate cryptocurrency or other virtual digital

assets, the recipient will be taxed at the same rate.

"The law allows for the concept of virtual digital

asset, which is broad enough to embrace developing digital assets such NFT,

assets in the metaverse, digital currencies, tokens, etc," said Atharva

Sabnis, BACC member. Any non-Indian or non-foreign monetary information, code,

number, or token is generated cryptographically.

The new tax system on cryptocurrencies is proposed to take

effect in Assessment Year 2023–24. Cryptocurrency revenue will be taxed at 30%

starting in 2022-23.

In India, a 30% cryptocurrency tax is calculated

Frequently Asked Questions (FAQ) on Crypto Asset TaxationFinance Ministry of India

How is the 30% crypto tax calculated in India?

Bitcoin and other cryptocurrencies can be bought in India from BitBns Exchange, which is based in the country

.gif)

Hack-Proof Your Crypto Journey

Hack-Proof Your Crypto Journey