The Bitget exchange offers the most rapid cryptocurrency trading

Bitget is a cryptocurrency exchange based in Singapore. The platform offers a wide variety of crypto coins and tokens for trading on spot or futures markets at low trading fees.

Bitget is a trustworthy exchange because it holds regulatory licences from the United States, Canada, and Australia. Bitget is available on both mobile and desktop, and the sign-up process is straightforward. The platform offers its users free copy trading as well as attractive incentives for professional traders who allow others to copy their strategies. Bitget could be the exchange for you if you want an exchange with a large number of small market coins or the ability to copy trade. Read CCFO's Bitget review before signing up for Bitget.

Overview of Bitget

Users can copy trade for free, and traders who create strategies can earn up to 8% commission.

A diverse range of tokens with small market capitalizations

Low fees on all aspects of the platform 24-hour customer service

Cryptocurrencies are the only ones accepted. Cryptocurrencies 184+ Countries America, Canada, Australia, Europe, Korea, Japan, Latin America, India, Southeast Asia, and Africa are all represented.

How to Create a Bitget Account

By following the steps outlined below, you can easily set up a Bitget account:

Go to bitget.com or download the iOS or Android mobile app.

Click the "Sign Up" button in the upper right corner of the screen or app screen.

Select phone or email setup, then enter the address or phone number, create a password, and agree to the terms of service before clicking "Sign Up."

The Bitget Benefit

Purchase cryptocurrency

Asset protection

The platform will lock the seller's asset as soon as the buyer puts an order. In the case that a dispute arises, customer support will step in.

ideal quote

The system will match a user's order with the best deal for the appropriate payment method.

Cryptocurrency Deposit

You may start buying cryptocurrency with only one click and you don't need to be an expert

Users deposit large amounts of crypro assets as well as these features.

The first step into the world of cryptocurrency

Third-party funding

Support the purchase of cryptocurrency using multiple fiat currencies.

Simplex, Banxa, and Mercuryo Service Provider Platforms purchase BTC, USDT, and USDC, and you pay in USD or EUR. 50-20000.00 USD for a single transaction

How Can I Buy Crypto on Bitget?

Step 1: Choose the fiat to be paid for, the currency to be purchased, and the third-party service provider before clicking the buy button.

Step 2: Verify your identity on Bitget and third-party service provider websites before completing the payment.

Step 3: On the service provider's website, confirm the coins you purchased in your Bitget wallet coin financial record, as well as the order details.

Peer-to-Peer Trading on Bitget

Bitget P2P trading is a platform that allows Bitget users to exchange local currencies for cryptocurrencies on their own terms.

Peer-to-peer, or P2P, refers to a computer network model in which computers distribute and receive data or files on an equal basis. In this network, which is similar to a client-server network, each client acts as a server. It means that with Bitget's P2P service, two users interact directly on their own terms, with no third-party intermediary.

The Benefits of Bitget P2P Trading

The Bitget P2P Platform is accessible to anyone who has a registered Bitget account, has completed KYC verification, and has a bind phone number. You can now sell and buy cryptos with your local currency using Bitget's P2P trading platform at your preferred prices and payment method.

The following are the primary benefits of using the Bitget P2P trading system:

There are no trading fees on the Bitget P2P trading platform (Note: Depending on the payment method, there may be bank/wallet charges).

Bitget P2P provides users with the freedom to choose their preferred payment method, including bank transfer, PayPal, WebMoney, multiple global e-wallets, and online payment systems.

Secure transactions: When a buyer places an order, the platform locks the seller's asset. In the event of a dispute, the Bitget Customer Support team will step in.

Customer service is available 24 hours a day, seven days a week, and there is an anti-money laundering mechanism in place.

Section of Commerce

Trading on the Spot

Trading in Futures

FuturThe Benefits of Bitget P2P Tradinges on the USDT-M

USDT-settled futures contracts

USDT-Margined Futures on Bitget>

Bitget USDT-M Futures is the most user-friendly crypto derivatives product and was created to provide our users with the best trading experience.

Futures on Bitget with USDT margin

1. What is trading on margin?

Simply put, margin trading enables dealers to conduct futures trading operations without having a large amount of cash on hand. The first deposit will be based on the contract value, and you can borrow the remaining funds to increase your purchasing power through an amplification effect.

Margin trading encourages traders to review their positions every day. If a trader's account balance goes below a minimal threshold, the exchange may shut out any open positions until the trader's account balance reaches the minimum amount. In addition, traders have the option to deliberately exit some less advantageous positions rather than adding more equity to their accounts.

Perpetual Agreements>

Futures contracts on Bitget are typically perpetual, meaning they do not have a definite expiry date. The length of time traders choose to hold the contract is entirely up to them, resulting in an amazingly liquid market (entry and exit are made easy at very low costs). The index price of an asset, which is the average price of that specific asset in relation to its spot price and trading volume, is also the basis for perpetual contracts.

Input Fee>

A phrase unique to the cryptosphere is a fund fee, commonly referred to as a funding rate. Profits and losses cannot be computed in the same manner as typical futures contracts since perpetual contracts have no expiration date. The price differential between the perpetual market and the spot market, which is updated and realised every eight hours, is the basis for Bitget's fund fees. This cost is not charged by Bitget; instead, based on the open positions, winning accounts are credited with money deducted from loser ones. You may get more details about fund charges here.

2. Important words you'll encounter>

Some key phrases connected to margin trading are listed here to make the process easier for you to understand.

Variety of Margin

Initial margin, maintenance margin, variation margin, availability margin, and risk margin are the five different forms of margin on Bitget. Initial margin serves as a guarantee for the counterparty and is the absolute minimum amount of equity that must be deposited before opening any position. The maintenance margin is the minimum amount of equity to be maintained in the account during the life of each contract and is always smaller than the starting margin. In the event of a margin call, or when the account balance is lower than the needed maintenance margin, variation margin is calculated as the difference between the initial margin and the current (margin) balance. Accessible margin is the entire equity that is available for new trades each day, as seen by our users.

The risk margin seems to be the most difficult to understand of these five. It symbolises a trader's genuine delivery commitments.

Think about the following instance: John wants to purchase 5 BTC from Bitget since the prices are good. Due to the extreme volatility, he additionally tries to balance off this long position by taking a short position of 2 BTC, which lessens his commitment to provide all 5 BTC in the event that prices fall. As a result, 3 BTC, or the maximum level of John's risk margin, will be delivered in the event that BTC prices decline.

Modalities for Margin

Each position in the isolated margin mode will have a unique margin and distinct isolated margin account assigned to it. Isolated Margin accounts' initial margin is totally isolated from the rest of the available margin and from other accounts' initial margin. This option is intended for highly speculative trading because the maximum loss is limited to the Isolated Margin balance alone, and it pushes traders to actively manage each of their individual holdings.

Cross Margin allows all positions to access a single shared pool of margin, allowing traders to use all of the stocks in their margin account. Please be aware that one trader may have many margin pools of various cryptocurrencies using cross margin on Bitget. The associated joint pool can only be used by open positions with the same settlement (crypto)currency.

Trading pairings that are supported

On Bitget, there are more than 50 margin trading pairs with a 125X maximum leverage accessible. Profits and losses for USDT-M Futures will be settled in USDT.

Bitget Coin-Margined Futures

What exactly are Coin-Margined Futures?

Bitget has introduced Coin-Margined Futures, a new futures trading method. Unlike traditional trading methods, which only apply to corresponding coins, Coin-Margined Futures allow multiple currencies to be used as a margin for multiple future trading pairs. Using ETH as a margin, for example, you can now trade BTCUSD, ETHUSD, and EOSUSD with profit and loss calculated in ETH. The feature gives you more trading options, effectively increases the utilisation rate of funds, and allows you to benefit from both trading interest and price increases.

Margin

The leverage principle of futures transactions is concentrated on the margin system of futures transactions; that is, when you conduct futures transactions, you do not need to pay 100% of the funds. To participate, you only need to invest a small amount of money at a specific ratio based on future value as collateral for futures performance. This fund is called margin.

Leverage improves fund utilisation significantly, but high returns come with high risks. The lower the required margin, the greater the trader's leverage.

Fee for Funding

Bitget Coin-Margined Futures' primary operating mechanism is the Fund fee. Through the regular exchange of fund rates between the long and short parties, the fund fee is set to ensure that the transaction price of the coin-margined futures closely follows the underlying reference price.

Bitget does not charge any fees for funding. Peer-to-peer funding fees are collected (between Bitget users). More information on the Bitget Coin-M Futures Fund Fee can be found here.

Futures with Perpetual Coin Margin

A Perpetual Coin-Margined Future is a type of derivative that does not have an expiration or settlement date. You can set the margin currency to any currency supported by the platform and calculate the profit and loss in that currency. Funding rate swaps serve as an anchor for the spot price.

Currency for margin support

Perpetual Coin-Margined Futures can use the platform's currency as the futures margin, and the margin currency is used for profit and loss settlement.

Futures on the USDC-M

Perpetual futures with USDT settlement

Futures on Coin-M

As universal margins, support BTC, ETH, XRP, USDC, and others.

USDC Futures Modelling

Trading Practice

"Coin-M Futures Demonstration"

Trading simulation

Bitcoin Futures Contracts On Bitget

What is the definition of a Bitcoin Futures Contract?

A Bitcoin Futures Contract is a derivative product that functions similarly to traditional futures contracts. It is a contract between two parties to buy or sell a specific amount of bitcoin at a future date.

Each future transaction will include a long (purchase agreement) and a short position (agree to sell). If a buyer goes long on a Bitcoin futures contract and the contract's marked price is higher than the forward price at the expiration date, the buyer profits and the short position loses.

If the marked price is lower than the forward price at the expiration date, you will lose money and the profit from the short position.

What is the purpose of the Bitcoin Futures Contract?

Speculation

Bitcoin Futures Contracts may be used for speculative purposes by some investors. They could make a lot of money if they correctly predict market movements.

It entails numerous and complex trading strategies, which are not suitable for inexperienced investors.

Reduce the possibility of volatility

But the main purpose of the Bitcoin Futures Contract is to manage the risk. Both buyers and sellers can purchase a specific number of bitcoins by locking them up at a future fixed price. It aims to reduce the risk of Bitcoin price volatility. This is known as "hedging."

Futures contracts have long been used as a hedge, particularly in commodity markets such as oil and rice. War, climate, and political factors can all have an impact on the price of oil and rice.

To reduce the risk of volatility, both the buyer and seller always purchase at a fixed transaction price and quantity by establishing futures contracts. Sellers require consistent earnings to cover costs. Buyers must purchase at a consistent price and quantity to meet their needs.

Bitcoin miners, like commodity sellers, may enter into a short position to protect the value of the Bitcoin they mined.

They must cover the mining costs for electricity and hardware.

Diversification

Bitcoin Futures Transactions allow investors to diversify their portfolios. You can build a well-balanced portfolio of various coins and products.

The Benefits of Investing in Bitcoin Futures on Bitget

Bitget, which was founded in 2018, is now the dominant crypto derivatives trading platform, offering a variety of innovative products, including Bitcoin Futures Contracts.

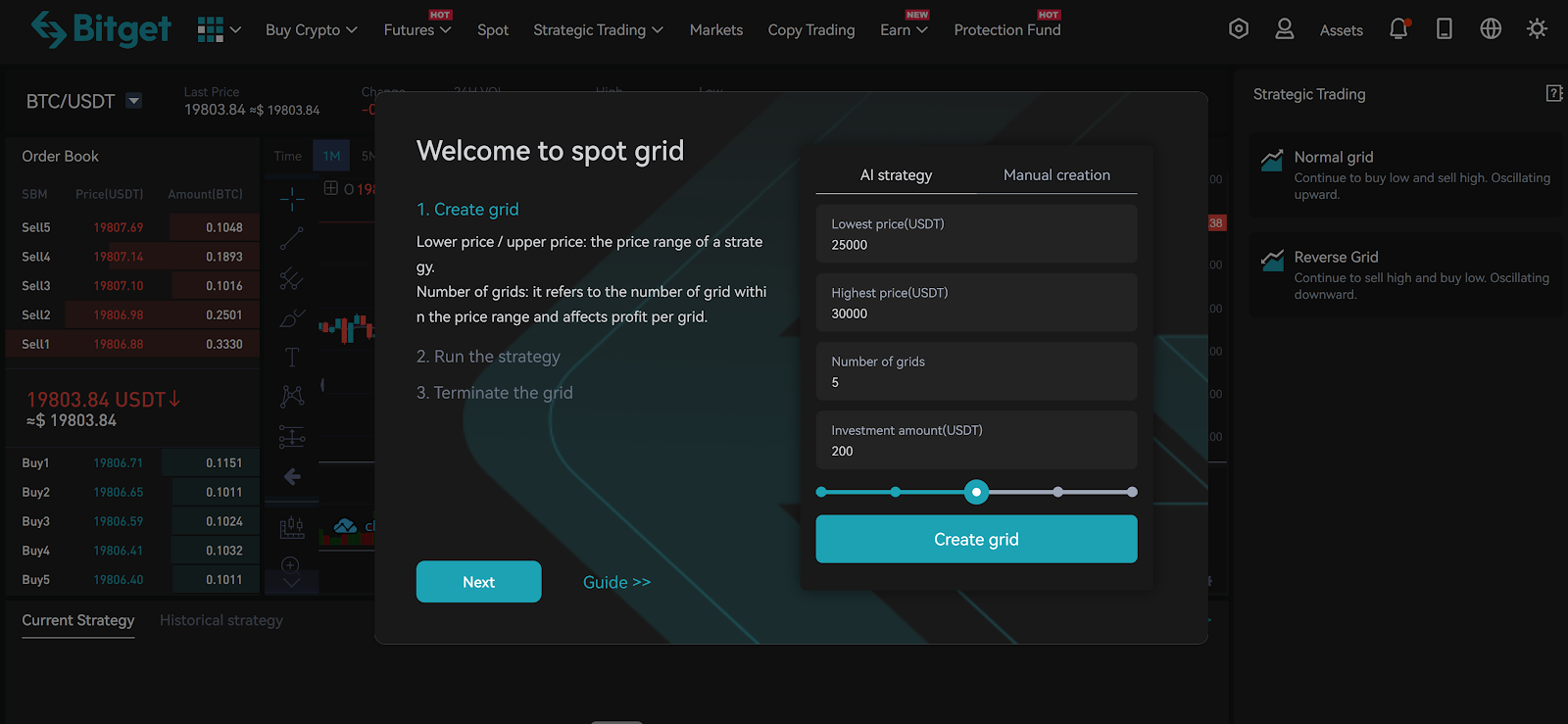

Trading on the Strategic Grid"

In a range-bound market, grid trading is a form of quantitative trading strategy that aims to buy low and sell high. Grid Trading makes money out of market fluctuations. The bot will always sell a portion when the price goes a little up and buy a piece when it goes a little down based on your configuration as long as the price stays within your chosen range. You establish a Price Range for the bot and decide how many grids you want.

Spot trading on the grid

Spot Grid Trading is a quantitative trading strategy in which a trading bot automates your buying and selling in spot trading.

Before getting started, it's critical to comprehend the power of Bitget Spot Grid Trading. You will discover all there is to know about grid trading in this section.

"Trading in Future Grids"

A quantitative trading approach called futures grid trading aims to buy low and sell high in a range-bound market. The market's ups and downs are profitable for Futures Grid Trading traders. The bot will always sell/short a section when the price goes a little up and buy/long a piece when it goes a little down based on your configuration as long as the price stays within your chosen range. You specify a Price Range for the bot and decide how many grids you want.

Trading in imitation

Both novice investors and seasoned traders who lack the time to actively acquire and sell assets can consider copy trading. We shall go over the fundamentals of Bitget Copy Trade in this essay.In order to have the same positions as the experts they are copying, investors imitate or follow other investors (often known as professional traders or experts) in their trading. Copy trading is simple to use for investors, and transactions can be executed promptly and automatically.

Mirror trading gave birth to copy trading in 2005. At first, investors let others duplicate their trading methods by disclosing their trading histories. Consequently, a social trade network was produced. Numerous trading platforms enter this industry in order to implement second-speed copy trading by creating software systems because of the financial market's extreme volatility.

Particularly for day trading and swing trading techniques, copy trading is concentrated on short-term trading. Thus, copy trading is applicable to both the foreign exchange market and the cryptocurrency market.

Copy trading is a type of social trading in which one trader's positions are copied when opened or closed by the account of another trader. This can be done automatically or manually, and the individual can choose how they want to go about copy trading.

Section Earn

The ability to earn passive income from your crypto holdings has become a cornerstone of our industry, with the majority of major exchanges offering some sort of earning section.

Savings

Bitget also supports a savings section that allows users to deposit crypto and earn daily interest in a flexible manner that is redeemable at any time, which helps make up for the lacklustre earning section.

The APYs here are pretty good, ranging from 1.10% for BTC to 5.6% for DOT, though there are only 6 assets(XRP,TRX,SOL,ETH,NEAR,USDC) available for savings.

Bitget Discounts

Saving and earning cryptocurrency in a simple and secure manner! Flexible Deposit Est. for Dot, ETH, BTC, NEAR, and USDT Apy income

BGB

The Bitget ecosystem is supported by the Bitget Token (BGB). Holding and staking BGB entitles you to several perks. Purchase Bitget Token right away.

The native utility token of Bitget is called BGB (Bitget Token). To safeguard the rights and interests of the application, BGB has made adjustments and has taken the place of the original platform token BFT (Bitget Defi Token).

Within the Bitget ecosystem, BGB is used in numerous scenarios. BGB can be used as a social token for engagement between fans and copy traders as well as by traders to prove their rights and interests and to receive discounts on trading fees.

BGB is a native asset of Bitget that powers the entire Bitget ecosystem and has a wide range of uses and advantages. Let's look at the growing list of applications for BGB.

Fee subtraction

BGB provides Bitget exchange users with a discount on transaction fees.

BGB provides Bitget exchange users with a discount on transaction fees.

You can reduce the cost of executing a futures trade by 15% by utilising BGB as the margin. (coming shortly)

Get a 20% reduction when paying spot transaction fees with BGB (more information here).

Agreement margin

BGB can be used as a contract margin for trading contracts.

stake for gain

To earn value-added income, pledge BGB.

Trade for a living.

Depending on the value of the transaction, trading BGB can earn you tier awards.

Increase your income via wealth management.

BGB holders can purchase Bitget wealth management products to receive multipliers by holding BGB positions.

Launchpad

Use BGB to join the Launchpad quota and gain access to the premium early-stage investments.

Launchpool

For Launchpool, BGB serves as a set pledge pool, and pledging BGB entitles you to new currency prizes.

Vote for the list.

To determine whether the project will be live on Bitget and receive incentives, cast your BGB vote.

Discount

BGB holders are eligible for a minimum 50% discount on well-known, premium currencies.

1U exploded.

BGB holders are eligible to take part in the 1U time-limited snap-up activity.

super airdrop technique

Users who own BGB can occasionally receive the special token airdrop.

Get rid of the blind box.

To take part in the blind box opening event and win prizes, hold BGB.

BGB drawing

BGB positions allow users to participate in lottery drawings by consuming a modest amount of BGB.

The total supply of BGBs is 2,000,000,000.

Your Link to the Crypto Revolution

Connect your cryptocurrency, DeFi, and NFTs in novel ways. Use Bitget's BGB Token to unlock Web3 right now.

Receive a BGB Reward

BGB Earn is a Bitget asset management platform where you can invest and grow your BGB holdings. You can earn BGB every day by subscribing to a variety of products that support early redemption.

Feel the power of BGB!

Spread on Futures

You can save 15% on trading fees by using BGB as a margin.

Keep your eyes peeled.

You will receive a 20% discount on all trading fees when you trade with BGB.

Use BGB as collateral to increase collaboration opportunities with KOLs.

Benefits: Having BGB gives you access to Bitget rewards, private circle tickets, and other perks.

Keep your eyes peeled.

Stake to Earn with BGB to benefit from value-added income and earn a passive income.

Early Investment Opportunities

Bitget Launchpad enables early investment in emerging projects.

Keep an eye on the distribution of SpaceBGB tokens.

Here's how we'll get BGB to the moon:

There are 2,000,000,000 in circulation.

Earnings from BGB

You gain BGB. Low cut-off, high yield Products in general APR BGB Est.

Launchpad

The Bitget Launchpad

Before they take off, invest in the best.

We handpick the most promising projects for you to work on at the Bitget launchpad. BGB can now be used to purchase early-stage tokens.

The Bitget exchange offers the most rapid cryptocurrency trading.

Bitget's Défense Fund

Your safety is given top priority.

Bitget's mission is to encourage people all over the world to adopt cryptocurrencies. Bitget has pledged to keep a $200 million emergency insurance reserve for our users in order to provide investors with a safe and secure trading environment when using our platform.

Bitget Pros & Cons

Pros

- Low trading fees

- Copy trading for free

- Supports over 150 coins and tokens

Cons

- Crypto is only deposit and withdrawal method

- Missing a few major assets

- Lesser-known exchange

Overview of Bitget

Bitget, which was founded in 2018, is one of the fastest-growing derivatives exchanges. Bitget, driven by excellence and innovation, has launched three first-of-their-kind flagship products in three years: USDT-Margined Contract, One-Click Copy Trade, and Coin-Margined Contract. Bitget is now the fifth-largest derivatives exchange in the world, as well as the largest cryptocurrency derivatives copy trade platform.

Advantages Of Bitget

A strong product foundation: The product line includes spot trading, futures trading, copy trading, and C2C trading, with copy trading becoming the world's largest cryptocurrency copy trading product.

Excellent technical strength: independent product research and development, stable systems, demonstrating exceptional strength in security defence and response to extreme market conditions.

Strict risk control system: The risk control team is comprised of the world's top financial risk control elites, and A+ series risk control rules are used to protect user assets and ensure transaction safety.

Top-tier industry status: Bitget has grown to become the world's largest cryptocurrency copy trading platform and is ranked among the top five cryptocurrency futures trading platforms.

Bitget is a global company that employs over 260 people in more than 40 countries and regions.

7/24 quality service—account Bitget's managers, customer service representatives, and global KOLs provide timely and high-quality services.

Bitget's Successes

Futures trading volume: With an average daily trading volume of USD 5 billion, the top five futures trading volumes in the world.

Copy trade data—number one in the world, with more than 6 million completed trades.

Number of KOLs: There are over 10,000 KOLs worldwide.

Platform users—There are over 2 million platform users from over 40 countries and regions, including Japan, South Korea, Southeast Asia, Russia, Turkey, and others.

System stability-no downtime in extreme market conditions or safety risks, and no safety accidents since day one.

Considering making an investment? Bitget now sells BGB!

Bitget MD's motivational quote

The incredibly personable @GracyBitget, Managing Director of @bitgetglobal, provided the quote for inspiration.

.gif)

Hack-Proof Your Crypto Journey

Hack-Proof Your Crypto Journey